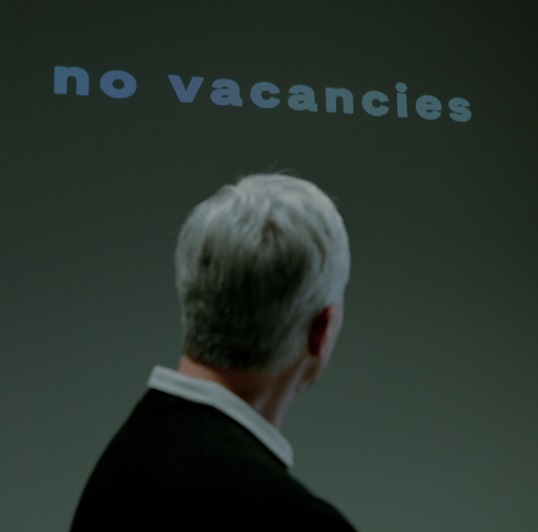

Recession Storm

As we progress through 2024, the United States finds itself at a critical economic juncture. A combination of rising unemployment rates, a series of Federal Reserve interest rate cuts, and ominous signals from the Sahm Rule have economists and analysts sounding the alarm. A recession appears to be knocking at the door, and for many young professionals who have only known a relatively stable economy, this looming downturn could be a rude awakening.

This article is not just a deep dive into the data—it is a wake-up call. Young professionals, the backbone of America’s future, need to be prepared for what could be a turbulent economic period. We’ll explore what’s happening in the economy, how the Sahm Rule serves as a recession indicator, and provide actionable advice on how to prepare for and navigate through these challenging times. We’ll also consider the potential global implications of a U.S. recession, further underscoring the gravity of the situation.

Chapter 1: Understanding the Economic Signals

The Rise in Unemployment: A Foreboding Indicator

In recent months, the U.S. unemployment rate has shown a concerning upward trend. What started as a minor uptick has evolved into a more persistent and troubling pattern. As of August 2024, the unemployment rate has climbed to 4.3%, up from the 3.4% we saw earlier this year. While a 4.3% unemployment rate may not seem catastrophic, the rapid increase in such a short period raises alarm bells.

To put this into perspective, the Sahm Rule, which we’ll explore in more detail later, suggests that a rise of 0.5 percentage points or more in the three-month average unemployment rate from its lowest point in the past year is a strong indicator that a recession is either imminent or already underway. Given the recent rise in unemployment, we are perilously close to crossing that threshold.

This rise is not just a statistical anomaly; it reflects real challenges in the labor market. Industries that were once booming, such as tech and real estate, are now laying off workers or implementing hiring freezes. For young professionals, this means a shrinking job market, with fewer opportunities and more competition.

Federal Reserve Interest Rate Cuts: A Double-Edged Sword

The Federal Reserve’s response to these economic challenges has been to cut interest rates in a bid to stimulate the economy. Over the past few months, the Fed has reduced interest rates multiple times, bringing them to levels not seen since the early 2020s.

Traditionally, cutting interest rates is a tool used to encourage borrowing and investment, as lower rates make loans cheaper for consumers and businesses. However, when rates are cut repeatedly and aggressively, it often signals that the central bank is worried about the economy’s trajectory. This series of cuts could be interpreted as a preemptive strike against a potential recession, but it also raises questions about the underlying health of the economy.

For young professionals, these rate cuts can have mixed effects. On the one hand, lower interest rates make it cheaper to borrow money for things like buying a home or financing education. On the other hand, they can signal economic instability, which may lead to job insecurity, wage stagnation, and a more challenging job market.

Chapter 2: The Sahm Rule and Its Implications

What is the Sahm Rule?

The Sahm Rule, named after famous economist Claudia Sahm, is a simple yet powerful tool for identifying the onset of a recession. According to the rule, a recession is likely underway if the three-month average unemployment rate rises by 0.5 percentage points or more from its lowest point in the previous 12 months. This rule has proven to be a reliable early indicator of recessions, accurately signaling downturns before they were officially recognized.

In the context of today’s economy, the Sahm Rule is particularly relevant. The recent rise in unemployment suggests that we are nearing the threshold that would trigger this rule, indicating that a recession might be closer than many would like to admit.

Why the Sahm Rule Matters Now

For young professionals, the Sahm Rule is more than just an abstract economic concept—it’s a practical tool that can help anticipate and prepare for economic downturns. If the rule is triggered, it will likely confirm what many already suspect: that the U.S. economy is heading into a recession.

This knowledge is crucial because it allows individuals to take proactive steps to safeguard their careers and finances before the worst of the recession hits. By understanding the implications of the Sahm Rule, young professionals can make informed decisions about their employment, investments, and financial planning

Chapter 3: How Young Professionals Can Prepare for a Recession

Building Financial Resilience

One of the most important steps young professionals can take is to build financial resilience. This means creating a buffer that can help you weather the economic storm that a recession might bring.

1.Boost Your Emergency Savings

If you haven’t already, now is the time to focus on building an emergency savings fund. Ideally, aim to save at least six months’ worth of living expenses. This fund can be a lifeline if you face job loss or unexpected expenses during a recession. Even if you’re currently employed and feel secure, it’s important to remember that economic conditions can change rapidly.

2.Reduce Debt

High-interest debt can be particularly burdensome during a recession. As interest rates fall, it might be a good time to refinance existing loans at lower rates, if possible. Focus on paying down debt, especially credit card balances, to reduce your financial obligations. This will free up more of your income to cover essential expenses if your income decreases.

3.Diversify Your Income Streams

Another way to build financial resilience is by diversifying your income streams. Consider taking on a side gig or freelance work that can provide additional income. This not only helps you save more but also gives you a backup source of income if your primary job is affected by the recession.

4.Be Cautious with Big Purchases ( Avoid EMIS)

In uncertain economic times, it’s wise to be cautious with big purchases. While lower interest rates might make it tempting to buy a home or a new car, consider whether this is the right time for such a significant financial commitment. If your job security is uncertain, it might be better to delay large purchases until the economy stabilizes.

Enhancing Job Security and Employability

Job security becomes a top concern during a recession. Young professionals must be proactive in safeguarding their employment and enhancing their employability.

1.Excel in Your Current Role

Now is the time to go above and beyond in your current job. Demonstrating your value to your employer can make you less likely to be laid off if your company has to downsize. Take on additional responsibilities, be a team player, and look for ways to contribute to your organization’s success.

2.Invest in Professional Development

Continuing education and professional development are crucial during uncertain economic times. By expanding your skill set, you increase your marketability and make yourself more attractive to potential employers. Consider taking courses in areas that are in high demand or gaining certifications that could give you an edge in your industry.

3.Network, Network, Network

A strong professional network can be a valuable asset during a recession. Networking can open doors to new job opportunities and provide support if you find yourself looking for work. Attend industry events, join professional organizations, and stay connected with colleagues and mentors. Building and maintaining relationships within your industry can help you stay informed about job openings and industry trends.

4.Consider a Career Pivot

If your industry is particularly vulnerable to a recession, it might be worth considering a career pivot. This could involve transitioning to a different role within your industry or exploring entirely new fields that are more recession-proof. Fields such as healthcare, education, and certain areas of technology tend to be more stable during economic downturns.

Managing Investments and Retirement Planning

The stock market often becomes volatile during a recession, which can have significant implications for your investments and retirement planning.

1.Stay Calm and Avoid Panic Selling

Market volatility can be unnerving, but it’s important to avoid making hasty decisions based on fear. Selling off investments during a market downturn can lock in losses and derail your long-term financial goals. Instead, focus on your long-term investment strategy and consider whether your current asset allocation aligns with your risk tolerance.

2.Diversify Your Investment Portfolio

Diversification is key to managing risk during a recession. By spreading your investments across different asset classes—such as stocks, bonds, and real estate—you can reduce the impact of market volatility on your portfolio. Consider working with a financial advisor to ensure that your portfolio is well-diversified and aligned with your financial goals.

3.Continue Contributing to Retirement Accounts

While it might be tempting to reduce or pause contributions to retirement accounts during a recession, continuing to invest in your future is important. If you have a 401(k) or similar retirement plan, keep contributing to take advantage of employer matches and the potential for long-term growth. Remember, the market’s short-term fluctuations are less important than your long-term investment horizon.

4.Reassess Your Financial Goals

A potential recession is a good time to reassess your financial goals and ensure they are realistic given the current economic conditions. If necessary, adjust your savings and investment strategies to reflect the new reality. For example, you might decide to increase your emergency fund contributions while temporarily reducing discretionary spending.

Chapter 4: The Global Ripple Effect

A U.S. recession doesn’t just impact Americans—it has far-reaching consequences for the global economy. Here’s how a downturn in the U.S. could affect markets and economies around the world.

Impact on Global Trade

The United States is a significant player in global trade, and a recession here would likely lead to a slowdown in global trade activity. As American consumers and businesses cut back on spending, the demand for imported goods and services would decrease, impacting economies that rely heavily on exports to the U.S.

Countries like China, Germany, Japan, and Mexico, which have strong trade ties with the U.S., could see a decline in their export revenues. This could lead to slower economic growth in these countries and potentially trigger recessions in economies that are heavily dependent on trade with the U.S.

Emerging Markets at Risk

Emerging markets are particularly vulnerable to a U.S. recession. Many emerging economies rely on foreign investment to fuel their growth, and during a recession, investors often pull back from riskier markets. This can lead to capital outflows, currency depreciation, and financial instability in these countries.

Additionally, a slowdown in the U.S. could reduce demand for commodities, which are a major export for many emerging markets. This could result in lower commodity prices and further economic challenges for countries that depend on these exports.

Volatility in Global Financial Markets

Global financial markets are interconnected, and a U.S. recession could lead to increased volatility worldwide. As investors react to economic uncertainty, stock markets around the world could experience significant fluctuations. Safe-haven assets like gold and U.S. Treasuries might see increased demand, leading to sharp movements in asset prices.

Central banks in other countries might also feel pressure to cut interest rates in response to a U.S. recession, which could have various effects on global economies, including reduced returns on savings and potential bubbles in asset markets.

Potential for a Global Recession

In a worst-case scenario, a U.S. recession could trigger a global recession. The U.S. economy is deeply integrated into the global economy, and a downturn here could have a domino effect, leading to slower growth or contractions in other major economies. This could result in widespread economic challenges, including rising unemployment, reduced consumer spending, and financial instability across the globe.

Chapter 5: Navigating the Uncertainty

While the prospect of a U.S. recession is concerning, it’s important to remember that recessions are a normal part of the economic cycle. They present challenges, but they also offer opportunities for growth and resilience. Here’s how young professionals can navigate the uncertainty and emerge stronger on the other side.

Embrace a Growth Mindset

A recession can be a time of uncertainty and change, but it can also be an opportunity for personal and professional growth. Embrace a growth mindset by viewing challenges as opportunities to learn and improve. Whether it’s gaining new skills, exploring different career paths, or finding creative ways to manage your finances, a positive attitude can help you navigate tough times.

Focus on What You Can Control

During a recession, it’s easy to feel overwhelmed by factors beyond your control. While you can’t change the economy, you can take control of your personal and professional life. Focus on what you can do to improve your situation, whether it’s building your savings, enhancing your skills, or expanding your network. By taking proactive steps, you can better position yourself to weather the storm.

Stay Informed, But Avoid Overwhelm

Staying informed about economic trends and developments is important, but it’s also crucial to avoid becoming overwhelmed by negative news. Set boundaries around your news consumption to protect your mental health. Focus on reliable sources of information and seek out balanced perspectives. Remember, not all news is relevant to your personal situation, so filter out what doesn’t apply to you.

Seek Support When Needed

Recessions can be challenging, both financially and emotionally. Don’t hesitate to seek support if you need it. This might mean reaching out to a financial advisor for guidance, talking to a career coach about your job prospects, or connecting with friends and family for emotional support. Remember, you’re not alone in facing these challenges, and seeking help is a sign of strength, not weakness.

Chapter 6: Preparing for the Future

As we look ahead, it’s clear that the economic landscape is uncertain. However, by taking proactive steps and preparing for the possibility of a recession, young professi

onals can position themselves to navigate whatever comes their way.

Continue Building Resilience

Building resilience isn’t just about preparing for a recession—it’s about developing habits that will serve you well throughout your life. Continue to focus on financial stability, professional development, and personal growth. These efforts will not only help you weather economic downturns but also thrive in the long term.

Keep an Eye on the Long-Term

While the short-term outlook might be uncertain, it’s important to keep an eye on your long-term goals. Whether it’s saving for retirement, buying a home, or advancing in your career, stay focused on your future. By making decisions that align with your long-term objectives, you can navigate short-term challenges without losing sight of what’s important.

Be Adaptable and Open to Change

The ability to adapt to change is one of the most valuable skills you can develop. The economic landscape is constantly evolving, and being open to new opportunities and willing to pivot when necessary will help you stay ahead. Whether it’s exploring new industries, learning new skills, or reevaluating your financial strategy, adaptability is key to thriving in a dynamic world.

Conclusion: Facing the Future with Confidence

The potential for a U.S. recession is a serious concern, especially for young professionals who are just beginning to establish their careers and financial foundations. However, by understanding the economic signals, preparing for potential challenges, and adopting a proactive mindset, it’s possible to navigate these uncertain times with confidence.

The actions you take now—whether it’s building your financial resilience, enhancing your skills, or staying informed—will not only help you weather the storm but also position you for success in the future. Remember, recessions are a part of the economic cycle, and while they bring challenges, they also offer opportunities for growth, learning, and adaptation.

As we move forward into an uncertain economic future, young professionals have the chance to not only survive but thrive. By facing the future with confidence, resilience, and a growth mindset, you can turn potential challenges into opportunities and emerge stronger on the other side.

This article is your call to action. The economic storm may be gathering, but with preparation, knowledge, and determination, you can face it head-on and come out ahead. The future is uncertain, but with the right mindset and strategies, you can navigate it successfully and build the life and career you desire.

Disclaimer:

This article is intended for informational purposes only and should not be considered as financial or professional advice. The economic scenarios and suggestions discussed are based on current data and trends, which may change over time. Readers are encouraged to consult with financial advisors, career counselors, or other professionals before making any decisions based on the content of this article. The author and publisher are not responsible for any actions taken or not taken as a result of reading this article. Individual circumstances may vary, and all decisions should be made with careful consideration.

Vitazen Keto Gummies There is definately a lot to find out about this subject. I like all the points you made

Thanks for appreciaiting my blogs .

Simplywall Great information shared.. really enjoyed reading this post thank you author for sharing this post .. appreciated

Thanks for appreciating my following blog post . Keep reviewing to encoruage to write good blog post.

allegheny county real estate This is really interesting, You’re a very skilled blogger. I’ve joined your feed and look forward to seeking more of your magnificent post. Also, I’ve shared your site in my social networks!

Thanks for appreciating my blog post. Check my another website http://www.mybeaudate.in

Techarp I very delighted to find this internet site on bing, just what I was searching for as well saved to fav

Thanks for appreciating my blog post. Check my another website http://www.mybeaudate.in

Tech to Force Very well presented. Every quote was awesome and thanks for sharing the content. Keep sharing and keep motivating others.

Thanks for appreciating my blog post. Check my another website http://www.mybeaudate.in