ESIC Scheme For Employees

The Employee’s State Insurance (ESI) Scheme is a landmark social security initiative in India, designed to provide financial protection and healthcare benefits to employees working in the organized sector. Introduced under the Employees’ State Insurance Act, 1948, the scheme ensures comprehensive medical care and social security to workers earning up to Rs. 21,000 per month. Over the decades, the scheme has expanded its reach to encompass a vast healthcare network across all Indian states, benefiting millions of employees and their families.

History of the ESI Scheme

The ESI Scheme was inaugurated on February 24, 1952, by Prime Minister Jawaharlal Nehru in Kanpur, Uttar Pradesh. Initially, the scheme covered only factories with 10 or more employees earning up to Rs. 400 per month. Over time, it expanded to include shops, cinemas, hotels, restaurants, and private educational institutions. The wage ceiling was progressively increased to Rs. 21,000 (or Rs. 25,000 for employees with disabilities), ensuring wider coverage.

The scheme is administered by the Employees’ State Insurance Corporation (ESIC), an autonomous body under the Ministry of Labour and Employment, Government of India. It operates through a network of dispensaries, hospitals, diagnostic centers, and empaneled private facilities across the country.

Benefits of the ESI Scheme

The ESI Scheme offers a wide range of benefits to insured persons (IPs) and their families. These benefits are broadly categorized into medical care and cash benefits:

Medical Benefits:

Primary Care: Over 1,500 dispensaries provide outpatient services.

Secondary Care: 159 ESI hospitals cater to specialized healthcare needs.

Super-Specialty Care: 62 private hospitals across India are empaneled for advanced medical treatment.

Cash Benefits:

Sickness Benefit: 70% of wages for up to 91 days in two consecutive benefit periods.

Maternity Benefit: 100% of wages for 26 weeks (extendable by 4 weeks).

Disability Benefit: 90% of wages for temporary or permanent disabilities caused by work-related injuries.

Dependents’ Benefit: 90% of wages as a pension to dependents in case of the insured person’s death due to workplace injury.

Unemployment Allowance: Cash support for up to 24 months under the Rajiv Gandhi Shramik Kalyan Yojana.

Other Benefits:

Funeral Expenses: A lump sum of Rs. 15,000 to the family of the deceased insured person.

Education Benefits: Reservation of medical seats for wards of insured persons in ESIC medical and nursing colleges.

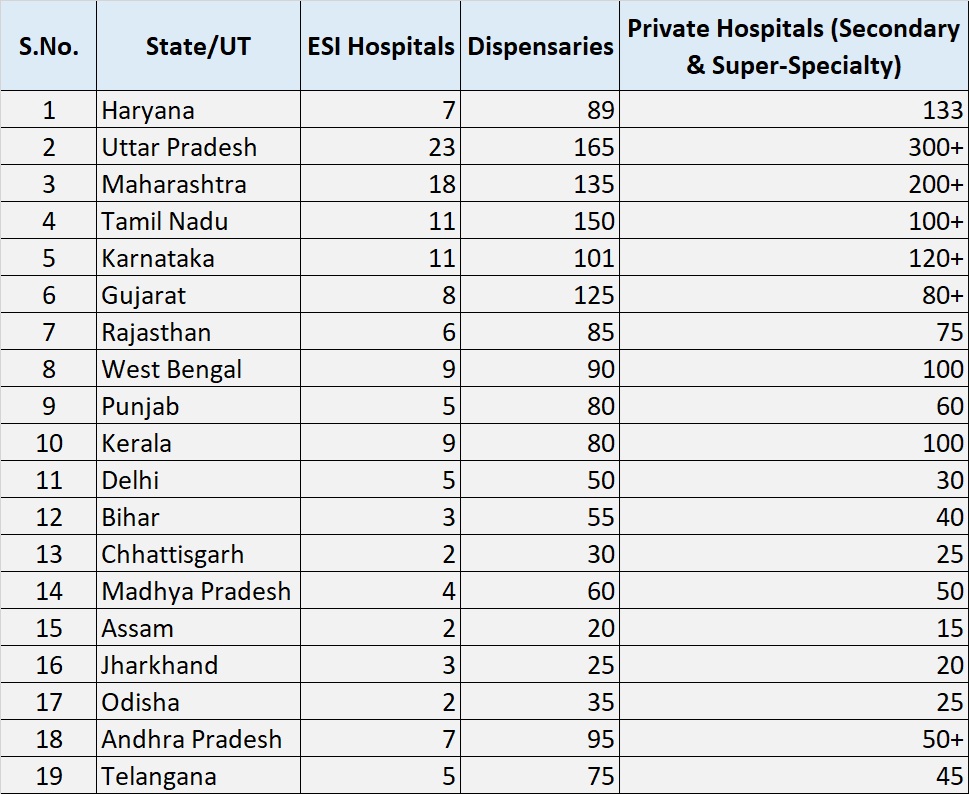

Quantitative Details of ESI Healthcare Network Across States

The ESI Scheme is implemented across all states and Union Territories through an extensive healthcare network. Below are the state-wise details of ESI hospitals, dispensaries, and empaneled private facilities:

How the ESI Scheme Works

Contributions:

Employer: 3.25% of wages.

Employee: 0.75% of wages.

Registration:

Employees earning up to Rs. 21,000 must be registered by their employer.

The employer submits monthly contributions through the ESIC portal.

Accessing Benefits:

Medical Services: Insured persons can visit any ESI dispensary, hospital, or empaneled private facility.

Cash Benefits: Claims are processed through the employer, and payments are directly credited to the beneficiary’s bank account.

Significance of the ESI Scheme

The ESI Scheme is a cornerstone of India’s social security framework, with far-reaching implications for employees’ well-being:

Health Security: Provides free or subsidized healthcare to millions of workers and their families.

Financial Stability: Ensures income replacement during sickness, maternity, or disability.

Comprehensive Coverage: Addresses medical, financial, and social contingencies.

Nationwide Reach: Operates in even remote areas, reducing disparities in healthcare access.

Challenges and Recommendations

Despite its success, the scheme faces challenges, including:

Awareness: Many eligible workers remain unaware of their entitlements.

Infrastructure: Some states face shortages of hospitals and dispensaries.

Coverage Gap: The unorganized sector remains largely uncovered.

Recommendations:

Launch awareness campaigns to educate workers and employers.

Upgrade medical infrastructure, especially in underserved regions.

Extend the scheme to informal sector workers through innovative financing models.

Conclusion

The Employee’s State Insurance Scheme has emerged as a model of inclusive social protection, addressing the healthcare and financial needs of India’s workforce. Its vast healthcare network, comprehensive benefits, and affordability make it indispensable for employees and their families. By addressing challenges and expanding its scope, the ESI Scheme can continue to serve as a safety net for millions of workers across the country.

Disclaimer

This blog is intended for informational purposes only and does not constitute legal or professional advice. The details provided here are based on the latest available information and are subject to change as per government policies. Readers are advised to refer to the official ESIC website (www.esic.gov.in) or contact their nearest ESIC office for updated and accurate information. The author assumes no responsibility for decisions made based on this content. The author wants to make aware about the social security schemes available for employees in his blogs to benefit them.

Recent Comments